georgia ad valorem tax refund

The tax is levied on the assessed value of the property which by law is established at 40 of fair market value. This tax is based on the cars value and is the amount that can be entered on federal Schedule A for an itemized deduction if the return qualifies to itemize deductions rather than take the standard deduction.

Income Tax Refunds Georgia Gov

The administration of tax exemptions is as interpreted by the tax commissioners of Georgias 159 counties.

. The Georgia Annual Ad Valorem Tax applies to most vehicles purchased prior to March 1 2013 and non-titled vehicles and qualifies as a Personal Property Tax. The two changes that apply to most vehicle transactions are. Request an additional six months to file your Georgia income tax return.

The Title Ad Valorem Tax TAVT or Title Fee was passed by the 2012 Georgia General Assembly with additional amendments made during the 2013 legislative session. If you purchased your vehicle in Georgia before March 1 2013 you are subject to an annual tax. IRP registered trucks will pay apportioned ad.

Vehicles purchased on or after March 1 2013 and titled in Georgia are subject to Title Ad Valorem Tax TAVT and are exempt from sales and use tax and the annual ad valorem tax. This tax is based on the value of the vehicle. Georgia Tax Center Help Individual Income Taxes Register New Business Business Taxes Refunds Information for Tax Professionals.

In order to be deductible as a personal property tax it. Related Agency Department of Revenue. Check your refund online does not require a login Sign up for Georgia Tax Center GTC account.

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. Wheres My Refund. Ad Valorem Vehicle Taxes.

TAVT is a one-time fee that replaces the sales tax and the annual ad valorem tax often referred to as the birthday tax on motor vehicles. March 17 2021 513 PM. To enter your Personal Property Taxes take the following steps.

The actual filing of documents is the veterans responsibility. MV-33 Georgia Department of Revenue Title Ad Valorem Tax TAVT Refund Request. Effective January 1 2022.

GA Code 48-5-47 65 Years of Age and Low Income Exemption Individuals 65 Years of Age and Older May Claim a 4000 Exemption. The TAVT would have imposed a 65 tax on the purchase of truckstractors titled in Georgia. GDVS personnel will assist veterans in obtaining the necessary documentation for filing.

Questions Answers on Georgia Title Ad Valorem Tax TAVT Why is the system for paying my annual vehicle ad valorem taxes changing. You can deduct only the Ad Valorem Tax portion of the annual auto registration on your Federal Schedule A. The amount of tax is determined by the tax rate mill rate levied by various entities one mill is equal to 1 for each 1000 of assessed value or 0001.

Form MV-7L - State and Local Title Ad Valorem Tax TAVT Fees for Leases 23804 KB Department of. Is this going to effect when I get my return and if so how can it be fixed. Taxes must be paid by the last day of your registration period birthday to avoid a 10 penalty.

The new Title Ad Valorem Tax TAVT does not appear to be deductible for Federal or Georgia purposes. TITLE AD VALOREM TAX IS NO-MORE for trucks registered in Georgia under IRP and will remain free from Title Ad Valorem Tax TAVT that went into effect on March 1 2013. Ad Valorem Tax on Vehicles.

Title Ad Valorem Tax Estimator calculator Get the estimated. Hello Redditors Im new to the State of GA and purchased a new vehicle in this State. GTC provides online access and can send notifications such as when a refund has been issued.

Georgia - Auto Registration and Ad Valorem Tax The State of Georgia has an Ad Valorem Tax which is listed on the Motor Vehicle Registration certificate. Ad valorem taxes are due each year on all vehicles whether they are operational or not even if the tag or registration renewal is not being applied for. As a result the annual vehicle ad valorem tax sometimes called the birthday.

I am planning on transferring plates that I already paid the Ad Valorem tax to this new vehicle. Under Cars and Other Things You Own- Show more and Start or Revisit Car Registration Fees. Get the estimated TAVT tax based on the value of the vehicle using.

Local state and federal government websites often end in gov. The tax is tied to your cars value which is why its called an ad valorem tax. The state of Georgia charges a one-time tax when you first buy and title a car.

MV-33 - Georgia Department of Revenue DOR Title Ad Valorem Tax TAVT. 2 The most common ad valorem taxes are property taxes levied on real estate. Use the automated telephone service at 877-423-6711.

Quick Links Georgia Tax Center. Georgia Ad Valorem Trucking Update. Ad valorem tax for state purposes will be due on the assessed value of land that exceeds the 10 acre limitation.

4 Property ad valorem taxesi. The tax must be paid at the time of sale by Georgia residents or within six months of. Hes in rehab at the moment and I asked him to.

The TAVT rate will be lowered to 66 of the fair market value. Key Takeaways 1 An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. In the most recent legislative session the Georgia General Assembly passed Senate Bill 65 which made several changes to the title ad valorem tax TAVT code sections which apply to vehicles purchased or sold on or after January 1 2020.

The claim for refund should be filed in writing with the board of commissioners within three years after the date of payment. You will now pay this one-time title fee when registering your car. Use Ad Valorem Tax Calculator.

Tax amounts vary according to the current fair market value of the vehicle and the tax district in which the owner resides. Ad valorem tax for state purposes will be due on the assessed value of land that exceeds the 10 acre limitation. However because its a one-time tax the IRS wont let you deduct it as a personal tax deduction.

Legislation enacted by the Georgia General Assembly in 2012 created a new system for taxing motor vehicles registered in Georgia. 3 The Latin phrase ad valorem means according to value. Related Topics Ad Valorem Vehicle Taxes.

The basis for ad valorem taxation is the fair market value of the property which is established as of January 1 of each year. Georgia Ad Valorem Tax. Title Ad Valorem Tax TAVT - FAQ.

The Ad Valorem calculator can also estimate the tax due if you transfer your vehicle to Georgia from another state. State and Local Title Ad Valorem Tax TAVT Fees for Leases. If you purchased your vehicle in georgia before march 1 2013 you are subject to an annual tax.

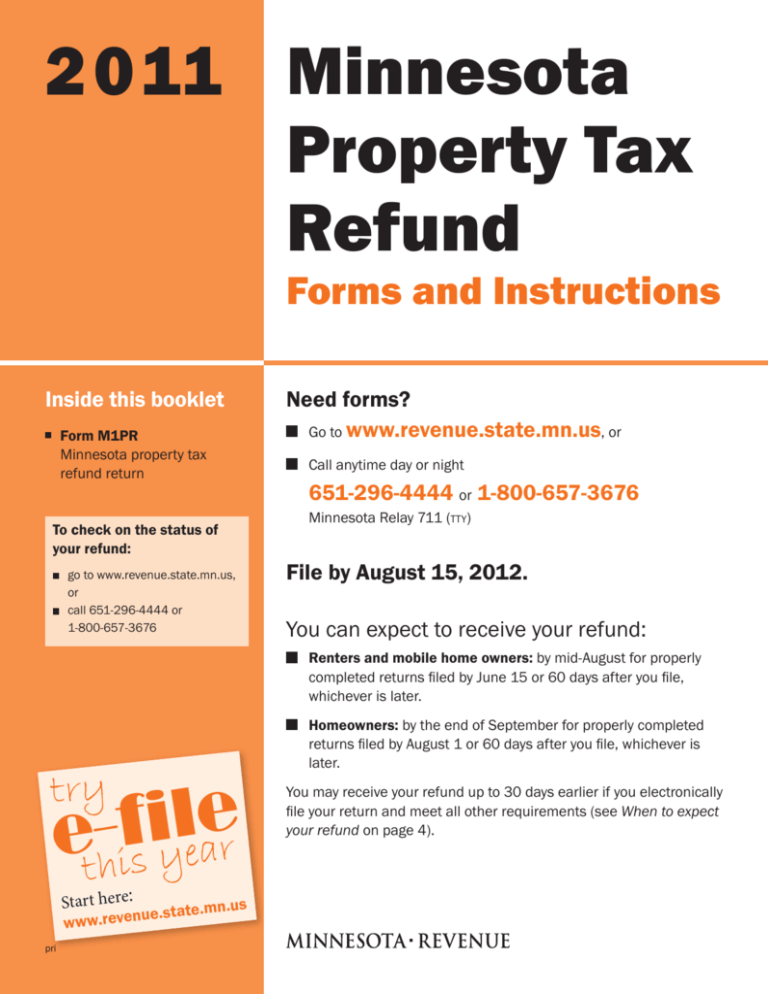

2011 Property Tax Refund Return Minnesota Department Of Revenue

Dor Businesses Submit A Refund Request Online With Intime

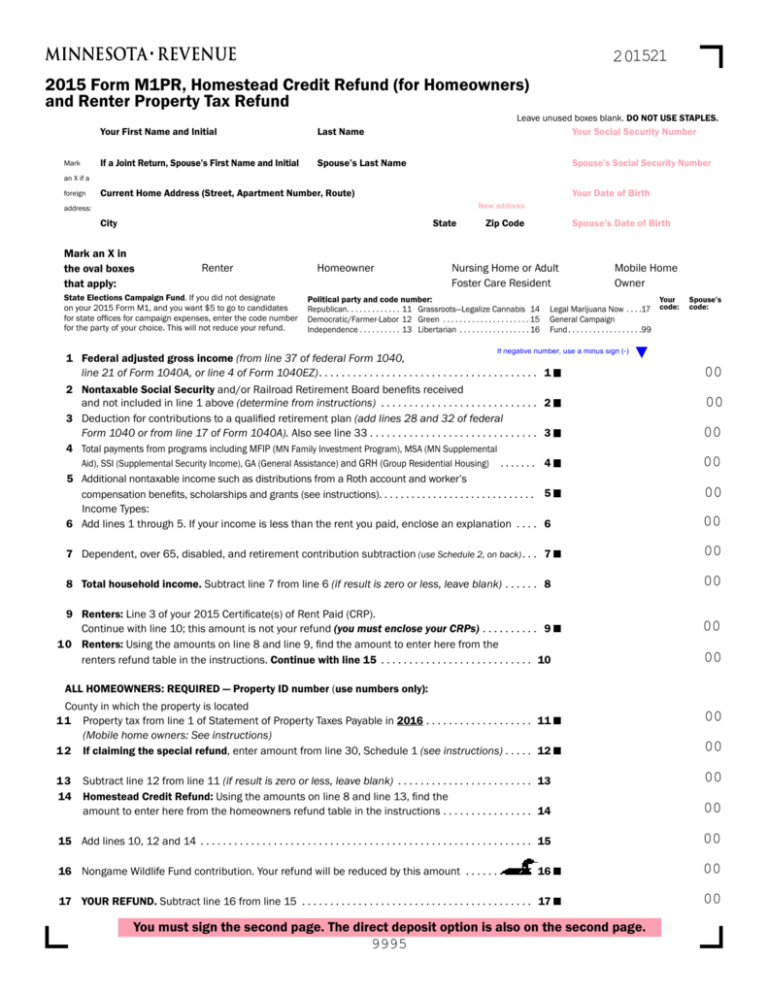

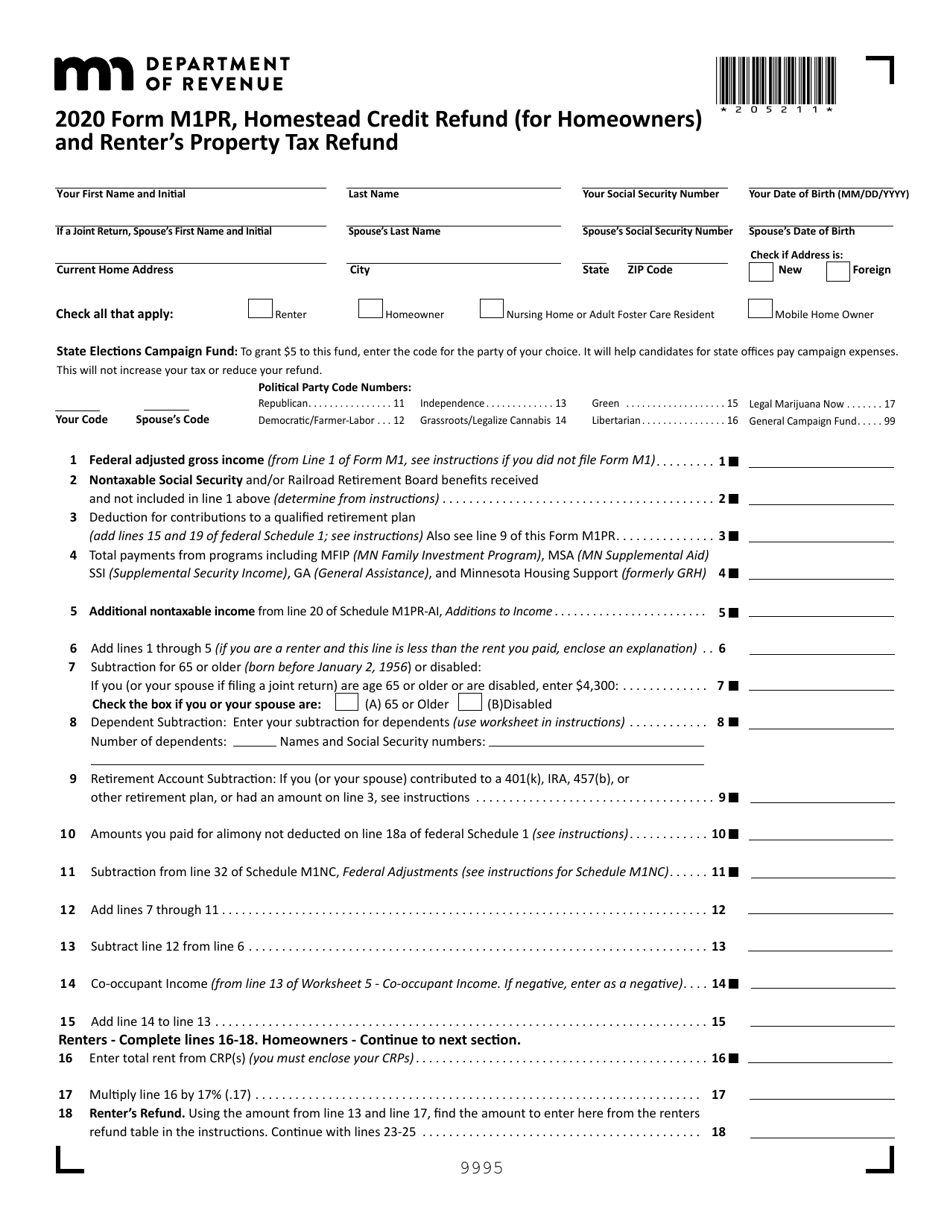

For Homeowners And Renter Property Tax Refund

Where S My State Refund Track Your Refund In Every State

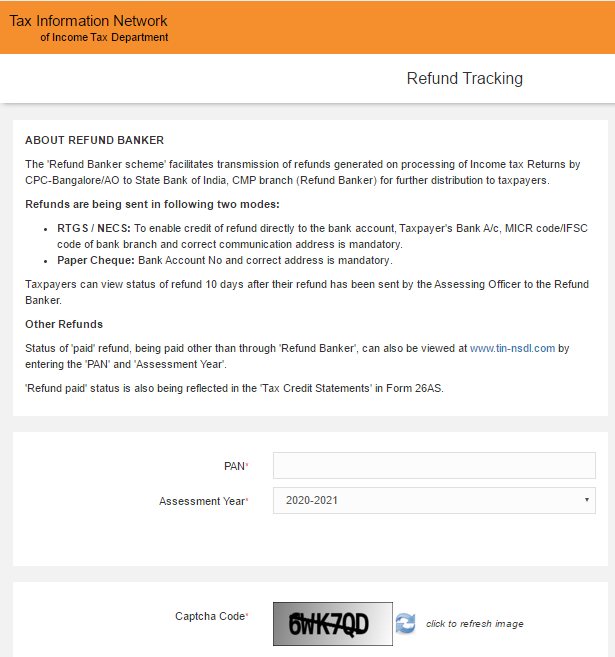

Income Tax Refund How To Check Claim Tds Refund Process Online

Property Taxes How You Could Be Getting Screwed Property Tax Estate Tax Tax Refund

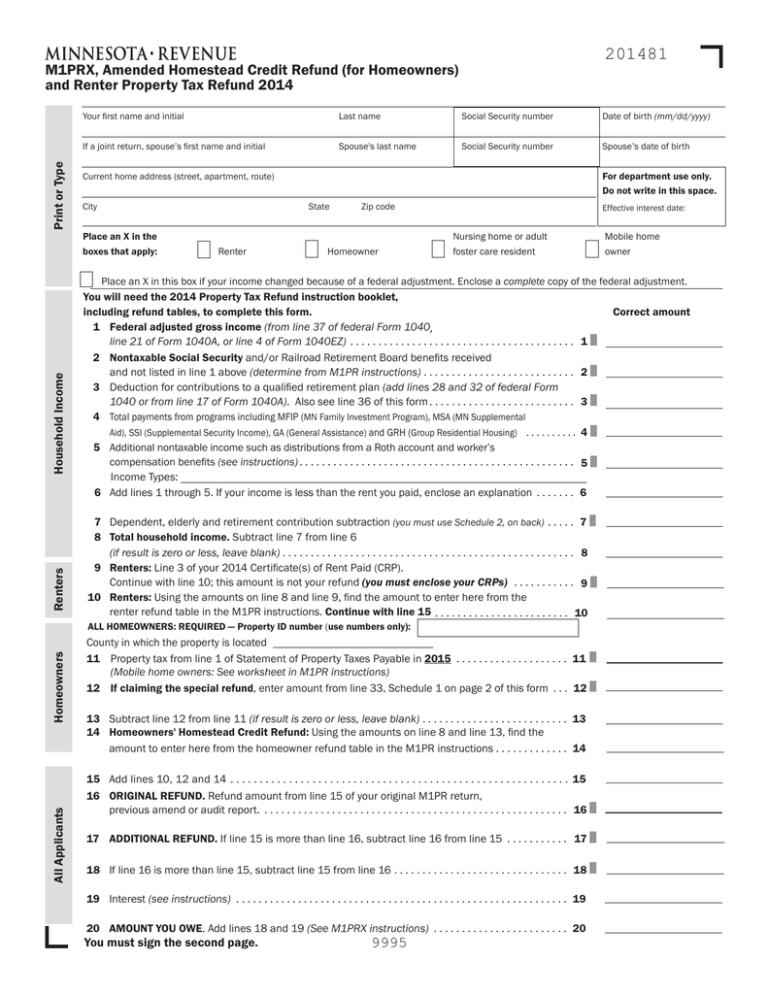

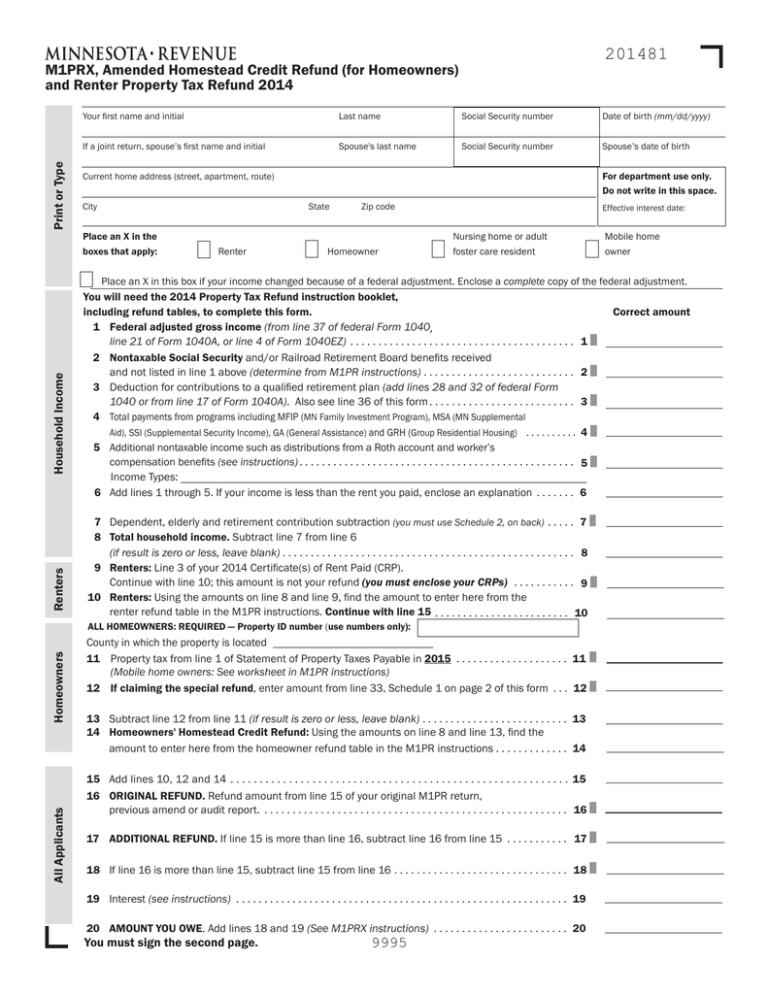

M1prx Amended Property Tax Refund Return

Form M1pr Download Fillable Pdf Or Fill Online Homestead Credit Refund For Homeowners And Renter S Property Tax Refund 2020 Minnesota Templateroller

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

A Guide On Property Tax Property Tax Tax Refund Types Of Taxes

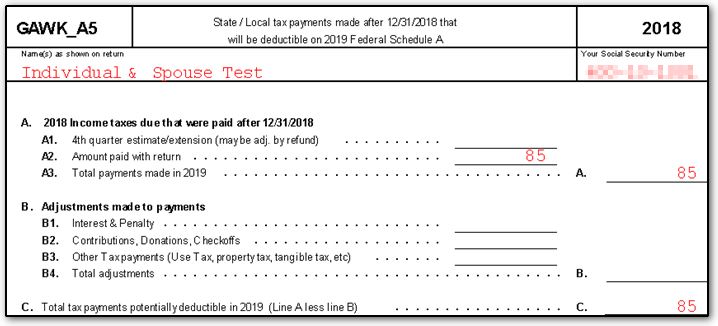

1040 State Taxes On Wks Carry Schedulea

Fuel Tax Recovery And Refund Services National Fleet Services Llc

Fast Tax Refunds 1stop Taxes Tax Refund Tax Accountant Business Tax

Form M1pr Fillable Property Tax Refund

Your Voice At The Irs Tax Refund Tax Services Money Management

Your Voice At The Irs Tax Refund Tax Services Money Management

Form M1prx Fillable Amended Property Tax Refund

Possible Sales Tax Reduction Filing Taxes Tax Services Tax Deductions List

Calculating Taxes Isn T Really A Fun Job And There Are No Two Ways About It There Are Many Technical Issues That Capital Gains Tax Income Tax Tax Accountant